Tern Share Price: What Investors Need to Know

Explore in-depth insights into the Tern share price, factors influencing its movement, historical performance, and smart investment strategies. Ideal for tech-focused investors.

Tern share price has become a topic of growing interest among tech investors and small-cap enthusiasts. If you’re exploring investment opportunities in emerging technology firms, you’ve probably come across Tern plc, a UK-based investment company that specializes in nurturing early-stage tech companies. But what really drives the Tern share price? How should investors interpret its fluctuations, and what should they consider before buying or selling Tern shares? In this comprehensive guide, we’ll explore all aspects of the Tern share price landscape, from market behavior to company fundamentals, and everything in between.

Understanding Tern and Its Market Position

Tern plc is not your traditional tech company. It’s more of a tech enabler. The company primarily invests in early-stage Internet of Things (IoT) businesses, providing them with not only funding but also strategic guidance, technological support, and operational help. That alone sets it apart from many competitors and gives context to its market behavior.

The Tern share price, therefore, is heavily influenced by the performance of its portfolio companies. Since Tern doesn’t generate revenue through traditional means like selling products or services, its financial health is often a reflection of how well its investments perform. This setup makes the Tern share price more volatile and speculative compared to more established, revenue-generating firms.

Another critical factor is Tern’s reputation in the AIM (Alternative Investment Market) space. Being listed on AIM gives the company access to capital but also subjects it to higher scrutiny and volatility. Investors interested in the Tern share price need to understand that AIM stocks, in general, are more prone to rapid changes based on market sentiment, news releases, and investor perception.

Factors Influencing the Tern Share Price

There are several variables at play when it comes to the movement of the Tern share price. For one, news surrounding its portfolio companies like Device Authority, Wyld Networks, or InVMA can have an immediate impact. For instance, a partnership announcement, new round of funding, or a product milestone achieved by one of these firms can give a temporary boost to Tern shares.

Moreover, general market trends, especially those affecting the tech and IoT sectors, play a major role. If there’s a bullish wave in the tech sector or an increase in demand for IoT solutions, the Tern share price often follows suit. Conversely, economic slowdowns, tech pullbacks, or negative sentiment around AIM stocks can pull the Tern share price downward even if the company itself is doing fine.

Investors should also keep an eye on Tern’s own announcements. Whether it’s a capital raise, a divestment, or a strategic shift, Tern’s management decisions send strong signals to the market. These company-level actions often ripple through the share price quickly and sometimes unexpectedly.

Why Tern Share Price Is So Volatile

One of the most frequent questions from retail investors is why the Tern share price seems to be on a rollercoaster. The answer lies in its business model and market environment. As an investment company focused on emerging tech, Tern’s fortunes are tied to companies that are still proving their market worth.

Investing in innovation is inherently risky. One success story among its portfolio companies can skyrocket the Tern share price. But a failure or even a delay in achieving milestones can send it tumbling. That’s just the nature of venture-style investing. Unlike mature firms with predictable revenue streams, Tern relies on a more speculative model, which is exciting but also nerve-wracking for investors.

The low liquidity of AIM stocks also amplifies volatility. Tern shares often experience large price swings on relatively low trading volumes. This means that even small-scale buying or selling can have a disproportionate effect on the share price, further enhancing its reputation as a high-risk, high-reward investment.

Tern’s Portfolio: The Heart of Share Price Movement

Understanding the businesses that Tern invests in is crucial to understanding Tern share price dynamics. Device Authority, a cybersecurity firm focused on IoT security, is often cited as the crown jewel of Tern’s portfolio. Progress or setbacks in Device Authority can move the needle significantly on Tern shares.

Wyld Networks is another key player. It works on IoT connectivity through low-power wide-area networks. With the world becoming more connected than ever, Wyld has huge potential, and any developments related to its partnerships or deployments can influence Tern’s valuation.

Then there’s InVMA, focused on industrial IoT solutions, and other smaller players in the portfolio. The combined performance, growth, and perceived potential of these firms determine how the Tern share price moves over time. Investors who track Tern closely often keep tabs on each of these portfolio companies as part of their analysis.

The Role of Investor Sentiment and Speculation

It’s important to recognize that the Tern share price is not just driven by numbers and performance reports. Investor sentiment plays a massive role. In the AIM market, buzz and hype can sometimes drive shares more than actual performance. That holds true for Tern, where message boards, forums, and social media often serve as breeding grounds for speculation.

This speculative nature means that rumors of a new funding round, a possible IPO of a portfolio company, or even vague hints from management can send the Tern share price soaring or crashing. For investors, this adds both opportunity and risk. On one hand, getting in early before a positive announcement can be rewarding. On the other hand, reacting to unverified information can lead to disappointment.

Investors should balance sentiment with solid research. Keeping a pulse on what the community is saying can be valuable, but it should be matched with a thorough understanding of Tern’s business model and financials to make informed decisions.

Historical Performance of the Tern Share Price

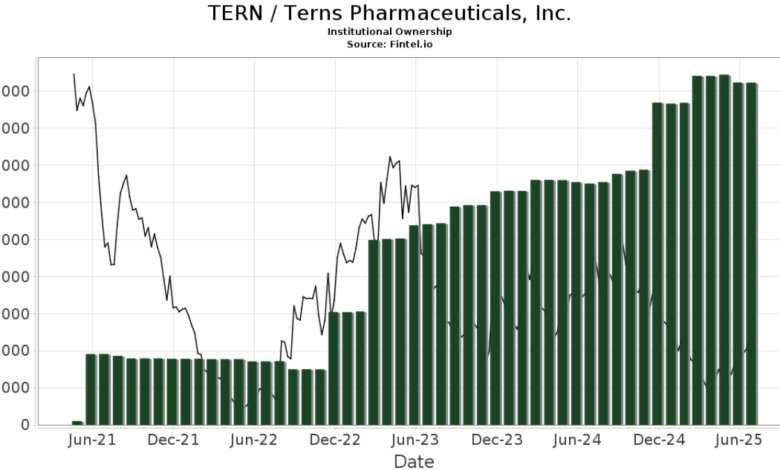

Looking back at the history of Tern share price provides useful insights. Over the years, the share has seen several dramatic rises and falls, each tied to specific events like acquisitions, portfolio updates, or market trends. These historical patterns can help investors identify potential entry and exit points.

For instance, there have been periods where the Tern share price doubled or tripled within weeks due to high expectations around Device Authority. But those spikes were often followed by sharp corrections. This boom-and-bust cycle highlights the importance of timing and risk management when dealing with Tern shares.

Understanding historical data doesn’t guarantee future results, of course, but it offers a frame of reference. If you’re planning to invest, studying charts and past performance should be part of your due diligence process.

Comparing Tern With Similar Investment Firms

To truly grasp where the Tern share price stands, it helps to compare Tern with other tech-focused investment firms. Firms like IP Group, Draper Esprit (now Molten Ventures), or Mercia Asset Management offer similar models but on different scales.

While Tern operates with a niche focus on IoT, others may have broader tech portfolios. This can affect share price stability. Larger firms with more diversified portfolios usually show less volatility but also slower growth. Tern’s concentrated strategy means higher risk but potentially higher reward.

Investors looking at the Tern share price in comparison should assess metrics like NAV (Net Asset Value), portfolio diversity, exit strategies, and capital structure. Doing so can reveal whether Tern is undervalued or overpriced in relation to its peers.

How to Analyze Tern Share Price Like a Pro

Analyzing the Tern share price isn’t just about watching the daily charts. It requires a multi-layered approach. Start by reviewing the latest RNS (Regulatory News Service) releases. These official announcements can include updates on portfolio companies, financial results, or strategic shifts.

Next, dive into investor presentations and annual reports. These documents offer insights into how Tern management views its investments and their future potential. Also, look at technical indicators like moving averages, support/resistance levels, and volume patterns. These can help in identifying short-term trading opportunities.

Lastly, keep an eye on market sentiment indicators. Monitor financial forums, Twitter discussions, and investor blogs to get a feel for the mood around Tern. Combining all these methods creates a more complete picture and helps you make smarter decisions regarding the Tern share price.

Tern Share Price and Long-Term Investment Strategy

For long-term investors, the Tern share price represents more than just a ticker symbol. It’s a window into the future of emerging technologies. Tern offers exposure to sectors like IoT, cybersecurity, and digital transformation without directly investing in startups.

This makes Tern a unique asset in any tech-oriented portfolio. However, it’s essential to maintain a long-term perspective. Short-term price swings can be unsettling, but the real value may unfold over several years as its portfolio companies mature and potentially go public or get acquired.

Patience and research are key. Investors who align with Tern’s vision and can tolerate volatility might find it a rewarding addition to their portfolio. Still, it’s wise to diversify and not allocate too much to a single speculative stock like Tern.

Frequently Asked Questions (FAQs)

What affects the Tern share price the most?

The Tern share price is mainly influenced by the performance of its portfolio companies, market sentiment, AIM volatility, and strategic decisions by its management.

Is Tern a good long-term investment?

It depends on your risk tolerance. Tern has potential for high rewards but comes with high risk due to its focus on early-stage tech firms.

Why is Tern share price so volatile?

Volatility arises from speculative trading, low liquidity on AIM, and the inherent risk of investing in early-stage tech companies.

Can Tern share price recover after a drop?

Yes, and it has in the past. Share price recovery often hinges on good news from its portfolio companies or positive investor sentiment.

Where can I track the Tern share price live?

You can track it on financial platforms like Google Finance, Yahoo Finance, or the London Stock Exchange website.

Conclusion

The Tern share price offers a fascinating glimpse into the world of high-risk, high-reward tech investing. With a unique portfolio and an agile business model, Tern continues to attract attention from investors who believe in the future of IoT and digital innovation. However, like any speculative asset, it requires a balanced, informed approach. By understanding what drives the Tern share price, monitoring market sentiment, and aligning your investment goals with Tern’s risk profile, you can navigate this dynamic stock with greater confidence.