GDR Share Price: Everything You Need to Know

Understand GDR share price with this expert guide. Learn what influences it, how to track it, and why GDRs matter for global investing. Easy-to-follow, comprehensive insights.

When it comes to global investing, the term “GDR share price” often pops up in market discussions. If you’re just starting out in investing or even if you’re a seasoned trader, understanding what GDRs are and how their share prices work can open up opportunities in international markets that you might be overlooking. This article will walk you through everything you need to know about GDR share prices, with clear insights and expert-level breakdowns.

What is a GDR and Why is it Important?

A GDR, or Global Depository Receipt, is essentially a way for companies to raise capital in international markets. It allows a company based in one country to list its shares on a foreign stock exchange. GDRs are commonly used by companies in emerging markets that want to attract investment from Europe, North America, or other developed regions.

For investors, GDRs offer a chance to diversify their portfolios without directly trading on unfamiliar or less-regulated foreign exchanges. Instead, they can invest in a foreign company’s equity through a GDR listed on their local stock exchange. This is where the GDR share price becomes a key metric. Just like any stock, the share price reflects demand, supply, and overall investor sentiment.

What makes GDRs particularly appealing is the transparency and standardization they bring to international trading. They are typically denominated in a stable currency like USD or EUR, and they comply with the listing standards of the exchange they’re traded on.

Factors That Affect GDR Share Price

Several factors influence the GDR share price, making it essential for investors to be aware of what can cause fluctuations. Understanding these variables helps in making informed decisions.

First and foremost, the financial health of the issuing company plays a big role. Just like regular shares, the performance of the company – revenue growth, profit margins, future outlook – significantly affects how the GDR is priced in the market.

Secondly, market sentiment and macroeconomic conditions can also drive GDR share prices up or down. For example, political instability in the company’s home country may lead to a drop in the share price, even if the company itself is doing well. Currency exchange rates also matter. Since GDRs are often priced in a foreign currency, fluctuations in forex rates can impact investor returns.

How to Track GDR Share Prices

If you’re wondering where to find accurate GDR share prices, you’re not alone. Unlike domestic stocks that are easy to track via national exchanges, GDRs might seem a bit elusive. But they’re not that hard to find if you know where to look.

You can track GDR share prices on global financial news platforms like Bloomberg, Reuters, and Yahoo Finance. Most stock brokers also offer real-time tracking features for GDRs, and some even let you set alerts so you can react quickly to market movements.

Another helpful tip is to monitor both the home market price of the underlying stock and the GDR. There can sometimes be a price difference (called arbitrage opportunity) between the two, depending on trading volumes, liquidity, and currency conversions. Savvy investors keep an eye on this.

GDR vs ADR: What’s the Difference?

People often confuse GDRs with ADRs, or American Depository Receipts. While they are quite similar, there are key differences that matter from an investment point of view.

GDRs are traded primarily on European and Asian stock exchanges, whereas ADRs are listed on U.S. exchanges like the NYSE or NASDAQ. The GDR share price will often be influenced by European market trends, regulations, and investor behavior.

Another key difference lies in their regulatory environment. ADRs must comply with U.S. SEC regulations, which are often more stringent. GDRs may not be subject to the same level of scrutiny, though they do need to meet the standards of the exchange they are listed on.

Benefits of Investing in GDRs

There are several compelling reasons to consider investing in GDRs. The most obvious is global diversification. By holding GDRs, you’re gaining exposure to foreign markets without taking on the risks of local trading in those regions.

Also, GDRs often come from emerging markets where growth potential is higher. As a result, the GDR share price might see significant appreciation over time, especially if the underlying company performs well on the global stage.

Many GDRs also pay dividends, and they are usually listed in a widely accepted currency like USD or EUR, which adds a layer of stability. For investors who want a global footprint without excessive complexity, GDRs offer a sweet spot.

Risks Associated with GDR Share Price

As with any investment, there are risks. The GDR share price can be volatile, especially if the issuing company is from a politically unstable region or operates in a volatile industry.

Currency risk is another factor. Even if the underlying asset performs well, changes in exchange rates can eat into your returns. Moreover, liquidity can be an issue. Not all GDRs are actively traded, so buying or selling in large volumes can be tricky.

Regulatory differences between countries can also pose challenges. Investors need to be aware of the tax implications and reporting requirements in their own country as well as in the country where the GDR is listed.

How Companies Benefit from GDRs

It’s not just investors who benefit from GDRs. Companies also gain a lot by issuing them. First off, they get access to a broader pool of investors, which can help raise more capital than they might on their domestic exchanges.

Listing GDRs on international exchanges also boosts a company’s global profile and can enhance its credibility. This can open doors to new partnerships, better credit ratings, and improved brand recognition globally.

It also gives companies more financial flexibility. With the funds raised through GDRs, they can invest in R&D, expand into new markets, or pay down debt. The impact of GDR share price performance can be directly tied to these strategic moves.

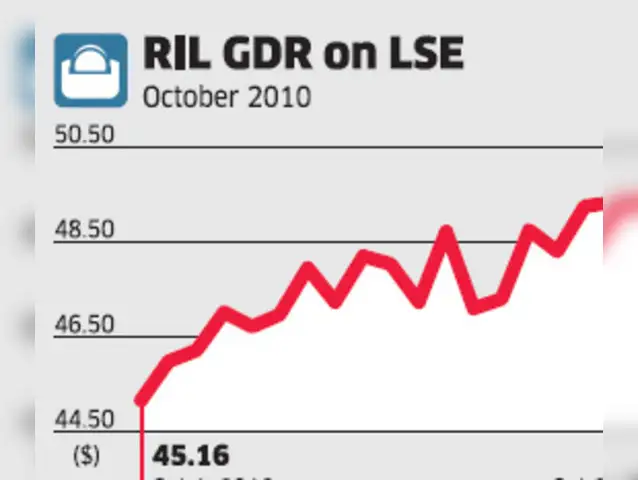

Trends in GDR Share Price Over the Years

Historically, the GDR market has shown resilience and adaptability. GDR share prices have mirrored global market trends but with some unique twists. During periods of global expansion, such as the tech boom or emerging market growth phases, GDRs have delivered strong returns.

Conversely, during global crises like the 2008 financial crash or the COVID-19 pandemic, GDR share prices took a hit. However, the bounce-back has often been quicker in GDRs related to fast-growing markets or sectors like technology and pharmaceuticals.

Today, many tech companies from countries like India, China, and Brazil are issuing GDRs. The share prices of these instruments are becoming an increasingly watched metric for global investors.

How to Invest in GDRs

Getting started with GDR investing is easier than you might think. Most major brokerage platforms offer access to GDRs, especially if you sign up for international trading services. Before investing, do your due diligence – check the company’s fundamentals, market conditions, and of course, the current GDR share price.

Also, keep an eye on fees. Since GDRs involve cross-border trading, they might come with higher transaction costs, taxes, or conversion fees. Understanding these costs ahead of time will help you make smarter investment choices.

Consulting with a financial advisor who has experience in international markets can also be a good step. They can help you create a strategy that fits your financial goals and risk tolerance.

GDR Share Price Analysis: What to Look For

Analyzing GDR share prices requires a multi-layered approach. First, look at the company’s earnings reports, revenue streams, and growth projections. These fundamental metrics are the foundation of any share price, GDR or not.

Next, look at the technical side. Chart patterns, moving averages, and volume trends can provide insights into where the GDR share price might be headed. Pair this with geopolitical and economic analysis for a well-rounded view.

Many seasoned investors also use comparative analysis. They compare the GDR price with the home market price of the stock to spot discrepancies. If the GDR is undervalued compared to the native share, it might signal a good buying opportunity.

Frequently Asked Questions

What does GDR stand for?

GDR stands for Global Depository Receipt. It’s a financial instrument that allows companies to list their shares on foreign exchanges.

Why should I care about GDR share price?

The GDR share price gives insight into how a foreign company is performing in the international market. It can be an investment opportunity or a diversification tool.

Are GDRs safe to invest in?

Like all investments, GDRs carry risks. These include political, currency, and liquidity risks. However, they can be part of a balanced portfolio.

How do I buy GDRs?

You can buy GDRs through international stock brokers or platforms that support global trading. Make sure to research the fees and regulatory rules involved.

Can I earn dividends from GDRs?

Yes, many GDRs offer dividends, though they may be subject to foreign tax laws and conversion fees.

Conclusion

Understanding the GDR share price is crucial for any investor looking to expand into global markets. With the right research and tools, GDRs can be a powerful addition to your investment strategy. Just make sure to consider the risks, stay informed, and diversify wisely.